- THE RIGD REPORT

- Posts

- 414.70% return on 9 $SPY bombs +(Stripe link???)

414.70% return on 9 $SPY bombs +(Stripe link???)

As the week's end dawns, options fade, markets frolic in folly. Step cautiously, safeguard the gains.

Good morning RIGD.

If you traded yesterday’s alerts, then do you even need to open the app today?

Pushing your luck will only go so far until you feel overconfident fall into tilt and try to make it all back in one trade before going to goblin town.

Perhaps this ancient Chinese proverb spoken ear to ear in a century old game of telephone will help guide you.

As the week's end dawns, options fade, markets frolic in folly. Step cautiously, safeguard the gains.

The stonk market is RIGGGGGD and yesterday’s action which we will attempt but surely butcharize in summary is another prime example and core thesis behind building this application.

Rest easy knowing whether it’s up or down RIGD AI will catch the move - you just need to be a little less chickenshit and trade it.

You in the sentence above actually means us because we missed the morning (maithais) and didn’t take the second wave due to chickenshit-ness.

Let’s jump in.

How much money you would have made trading every RIGD Alert and holding until end of day

During our formative years there were a few times when we have been punched in the face FOR ABSOLUTELY NO GOOD REASON

After settling down we were also engaged to the love of our life and she pulled a reverse Ariana Grande on us, leaving for an Ed Sheeran looking type of dude with worse tattoos and can’t even sing.

But none of that hurts like looking at yesterday’s returns for doing nothing but buying at the time of alert and holding until end of the day.

Our pain is now your pain.

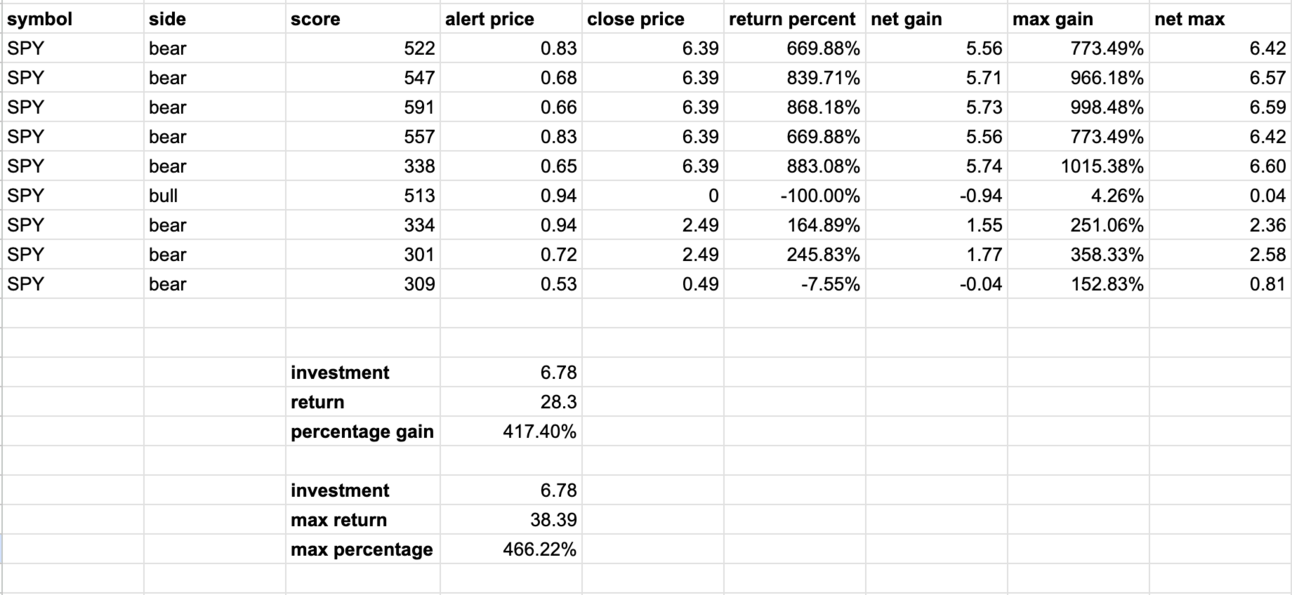

$SPY 9 alerts - 8 bear - 1 bull

Buying 1 contract of each alert and holding until end of day:

$678 for 9 contracts brought you $2,830 in net gains for a one day whopping return of 417.40%

By far the best day in RIGD history.

The QQQ was amazing, but not quite as good.

$QQQ 18 alerts - 9 bear - 9 bull - 118.56% return.

Buying 1 contract of each alert and holding until end of day:

$1,509 for 18 contracts brought you $1,789 in gains for a reasonably exciting return of 118.56%.

Max gain on perfect QQQ trades was higher at 225.98% given the four bear bombs fired from 14:33 - 14:36 returned 89.53% - 143.28% but all went negative by the close.

Unfiltered RIGD Commentary:

Holy shittttttt is a 267.98% return on all alerts for the day if you did absolutely nothing but buy and let your brokerage app close the position for you at the end of the session.

We think Robinhood does this for you automatically like 15 minutes prior to the close which would have set your returns higher because the market bottomed at exactly 15:46.

This strategy is stupid: No one… absolutely no one should buy a position and just let it run until the end of the day without looking at it. It only works when we get an outsized move in one direction or the other. On most days the market chops and all of your positions would go to zero.

Max return is stupider: Most of the other option alert apps will try to get you to join their service by flashing max gains and max returns, but these are a silly fantasy dreams like the ones we have with [ redacted ].

Data feed improvements: We’re working through this now (it is an alpha product after all) but soon we’ll be able to show returns based on your own drawdown and take profit settings. This will give a more accurate view of potential returns that aren’t pure yolo mode. Thinking through this now we should probably have a setting for default number of contracts and a “take profit + runner” setting where if 100% is hit you sell X amount of contracts and leave X amount on to run. Anything can happen in 0dte land like we saw yesterday.

End of session = insanity: Ever since we turned on hulk mode (different end of day weighting), we’ve been pulling in crazy trades like this bull and bear bomb both sent at the exact same time 15:44:58 (15m left in the session).

The crazy thing is it was possible to make money on each!

The bear bomb was up 102.56% in two minutes (because there’s no time left in the session), but ended down -79.49%.

Whereas the bull alert (higher score) was a 107.89% return at the close.

We had a few questions why or how RIGD AI could trigger the same alert in a one minute period.

The answer is we’re constantly receiving data on option flow and then the algorithm weights them and assigns a score. If big trades come in on both sides, then we’ll show alerts for each!

The other option apps (the bad guy shitheads) typically subtract call premium from put premium to indicate overall market flow.

But RIGD AI we are targeting the market maker lizard super whale traders. What are they doing and when are they moving into positions?

We want to follow them because they’ll take a trade even if FR (flore ratio) and FS (flore score) is against them and make the market move their way.

That is how we’re able to pin exact bottoms and tops.

And bulls at the bottom and bears at the top is how you have your very own red panty night.

1015.38% is the highest recorded in RIGD history… but they can get much crazier.

How insane can #0dte trades really get?

Let's look at the $SPY 454p today

1:00 - .02

3:46 - 2.37

11,750% return in 2hr 46m

We need a yolo mode...

— RIGD - ai (@rigd_ai)

2:05 AM • Jul 28, 2023

RIGD currently tracks pricing for the closest to the money call or put, but the eventual addition of LOTTOS / YOLO mode (you may need to sign an additional waiver to enable given the degeneracy and lunatic level risk) could highlight this activity.

Here’s a crazy one it picked up…

Yeah difficult to read but that’s 1317 contracts for the 457p at the ask (bearish) for 0.14 each at 13:05.

13:05 happens to be the the second red candle that started the massive selloff.

The 457p were bought at 0.14 and traded up to 5.40.

That’s a 3757.14% return.

Spicy…

Why the U.S. markets nuked yesterday (Japan got revenge???)

Maybe someone over in the Land of the Rising Sun is a bit upset about a movie being released that’s a reminder of the hundred thousand+ people killed in Hiroshima and Nagasaki… because this screams revenge story.

Background:

The Japanese Yield Curve Control policy (or the YCC as the in crowd likes to say) is probably the second most important thing to global markets after Jerome Powell.

The simple version and only one we somewhat understand is that lower Japanese yields means risk on buy stonks and higher yields means risk off, sell stonks.

So at 2 AM LOCAL TOKYO TIME…

WHEN EVERYONE IN TOKYO IS DEFINITELY READING THE NEWS AND NOT HANGING OUT IN KABUCHICHO DOING [ REDACTED ] TYPE THINGS…

The Japanese WSJ (the Nikkei) decides to drop a report that says the Bank of Japan would discuss tweaking its yield curve control policy and let interest rates rise.

The Bank of Japan will discuss tweaking its yield curve control policy at a policy board meeting Friday to let long-term interest rates rise beyond its cap of 0.5% by a certain degree, Nikkei has learned, in what would be a shift toward a more flexible policy approach.

Japanese interest rates up = risk off = sell stonks

And we nuked promptly after…

The RIGD nature of all this being that on July 26, Bloomberg already reported they would “discuss the issue”.

But it is what it is and it aint what it aint and the algos and lizard people who control the markets dumped everything.

When the meeting did occur and the issue was discussed Japanese JPow Kazuo Ueda said there would be more flexibility but the Bank of Japan is still far from the point of raising rates.

No Japanese rate raise, no risk off, means stonks go straight up with $SPY +0.92% and $QQQ +1.62%.

So why did we spend so much time writing about something we absolutely do not care about nor understand???

If you the retail trader is looking at yesterday’s session and listening to CNBC experts or furus bears on fintwit (we refuse to call it X)… you probably got all beared up.

The rally can’t keep going it already makes no sense!!!

But in reality the markets are run by robot algorithms and lizard people… it’s 100% RIGD against you.

And that’s why we built an app to follow their flow.

If you can’t beat them… join them (or us in this case).

Pre-sales for the RIGD AI Beta are back

JOIN THE RIGD AI BETA !

RIGD AI is the ultimate tool for the degen trader.

✅ Proprietary alerts for 0dte SPY and QQQ options

✅ An idiot friendly easy to follow trading system

✅ Badass community of lizard loving, bomb buying, option flippers

But…

RIGD AI is definitely not for everyone!

If you like technical analysis, patterns, widgets and waves, this is not for you!

If you like safety and dividends and watching trees grow, this is not for you!

But if you believe the stock market is RIGD (rigged)…

And you’re tired of losing to the lizards and their computer algos that dominate the markets…

Then why don’t you follow what really moves the market?

Up or down we do it every single day.

one good trade pays for a month or even years of membership

results not guaranteed you will likely lose 100% of your money

Accessing the beta:

We are awaiting final approvals on additional data licenses before RIGD AI is available to the public.

It’s expected these will go through next week.

As soon as they’re live, we’ll flip your account on and send you an invite to the community.

Pre-order details:

By pre-ordering you acknowledge that 0DTE options are probably the riskiest financial derivatives available and that you will most likely lose 100% of your capital for any actions taken when using the RIGD AI website.

We’ll have an actual disclaimer and terms and conditions by the time we go-live, but that’s the summary.

Not worth it. Don’t do it.

Note: if you took this offer earlier congratulations because you’re getting a month free + a custom RIGD orange rabbit foot you can clutch for good luck when you take a trade. No guarantee it will work or it’s not haunted.

thanks for reading THE REPORT by RIGD AI

First time reader?

we’re building tools for the modern degen investor

follow us on twitter @rigd_ai

Reply